General news

January Preferred Client

Canada’s slumping housing market weighs on Home Capital’s loans

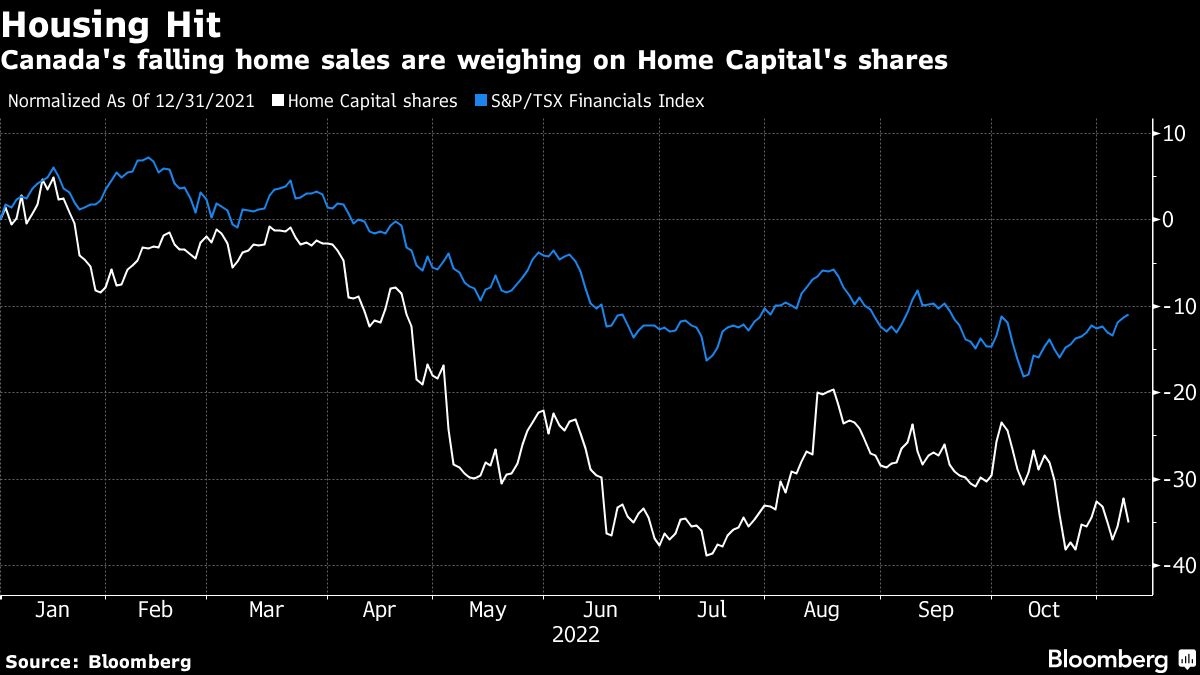

The tumult in Canada’s housing market is starting to take its toll on lenders, with Home Capital Group Inc. reporting a plunge in third-quarter originations.

Home Capital, which lends largely to borrowers considered somewhat riskier than prime customers, said Tuesday that single-family mortgage originations plummeted 28 per cent from a year earlier. The lender’s so-called Alt-A borrowers include self-employed workers or those who are new to Canada and don’t have extensive credit histories. Total mortgage originations fell 23 per cent to $1.85 billion (US$1.38 billion), missing the $2.5 billion estimate of Royal Bank of Canada analyst Geoffrey Kwan.

Sales activity in Canada’s housing market has slowed, with transactions down 32 per cent in September from a year earlier, as the Bank of Canada’s aggressive rate-hiking campaign ratchets up mortgage costs. Prices have fallen for seven straight months, and are down almost 9 per cent from their peak.

The market spiral had yet to make its way to lenders’ results, with Canada’s biggest banks all reporting growth in their mortgage books in their most recent earnings. Home Capital’s results provide a window into a segment of borrowers who are considered riskier than those the big banks typically take on, and therefore pay more to borrow.

“The housing market is currently in a period of transition as buyers and sellers adjust to a higher-interest-rate environment,” Home Capital Chief Executive Officer Yousry Bissada said in a statement, adding that the Toronto-based company expects “softer market conditions to persist in the near term.”

The drop in originations contributed to Home Capital’s net income falling 43 per cent to $31 million, or 77 cents a share. Excluding some items, profit was 95 cents a share, matching analysts’ estimates.

Home Capital’s shares fell 4.8 per cent to $25.23 at 10:32 a.m. in Toronto, bringing their decline this year to 35 per cent. That’s the fourth-worst performance in the 29-company S&P/TSX Financials Index.

Despite the market turmoil, Home Capital’s borrowers have continued to make payments on their mortgages. Net non-performing loans accounted for 0.16 per cent of gross loans last quarter. That compares with 0.15 per cent a year earlier and 0.47 per cent in the same period in 2020.

-Bloomberg

Winter Checklist

- Check and clean or replace furnace air filters each month during the heating season. Ventilation systems, such as heat recovery ventilator filters, should be checked every two months.

- After consulting your hot water tank owner’s manual, drain off a dishpan full of water from the clean-out valve at the bottom of your hot water tank to control sediment and maintain efficiency.

- Clean your humidifier two or three times during the winter season.

- Vacuum bathroom fan grills to ensure proper ventilation.

- Vacuum fire and smoke detectors, as dust or spiderwebs can prevent them from functioning.

- Vacuum radiator grills on the back of refrigerators and freezers, and empty and clean drip trays.

- Check gauges on all fire extinguishers, and recharge or replace as necessary.

- Check fire escape routes, door and window locks and hardware, and lighting around the home’s exterior. Ensure your family has good security habits.

- Check the basement floor drain to ensure the trap contains water. Refill with water if necessary.

- Monitor your home for excessive moisture levels – for instance, since condensation on your windows can cause significant damage over time and pose serious health problems, this requires corrective action.

- Check all faucets for signs of dripping and change washers as needed. Faucets requiring frequent replacement of washers may be in need of repair or replacement.

- If you have a plumbing fixture that’s not used frequently, such as a laundry tub or spare bathroom sink, tub or shower stall, briefly run some water to keep water in the trap.

- Clean drains in the dishwasher, sinks, bathtubs and shower stalls.

- Test plumbing shut-off valves to ensure they’re working and to prevent them from seizing.

- Examine windows and doors for ice accumulation or cold air leaks. If found, make a note for repair or replacement in the spring.

- Examine attic for frost accumulation. Check roof for ice dams or icicles. If there’s excessive frost or staining of the underside of the roof, or ice dams on the roof surface, be sure to have an expert look into the issue.

- Check electrical cords, plugs and outlets for all indoor and outdoor seasonal lights to ensure fire safety. If showing signs of wear, or if plugs/cords feel warm, replace immediately.

Bank of Canada expected to raise interest rates on Wednesday as recession fears grow

Even as warnings about a potential recession grow louder, the Bank of Canada is expected to announce another hefty interest rate hike on Wednesday, edging the bank closer to the end of one of the fastest monetary policy tightening cycles in its history.

RBC senior economist Nathan Janzen says it’s a coin toss between the Bank of Canada choosing to raise its key interest rate by half a percentage point or three-quarters of a percentage point, though RBC is leaning toward the smaller increase.

“It’s pretty clear that more aggressive interest rate hikes are still warranted,” Janzen said.

Wednesday’s announcement would make it the sixth consecutive time the Bank of Canada raises interest rates this year in response to decades-high inflation. It also comes amid growing fears that a recession is looming.

Last week, Finance Minister Chrystia Freeland shifted her tone on the economy from her usual praises of Canada’s strong pandemic economic recovery. She warned tough times are ahead for Canadians.

“Mortgage payments will rise. Business will no longer be booming,” Freeland said. “Our unemployment rate will no longer be at its record low.”

As well as the interest rate decision, the Bank of Canada will also release updated economic projections on Wednesday in its latest quarterly monetary policy report. The central bank’s outlook on inflation will be key to its plans for any additional rate hikes to come.

Since March, the Bank of Canada has raised its key interest rate from 0.25 to 3.25 per cent, feeding into higher borrowing costs for Canadians and businesses.

And although inflation has been slowing in recent months thanks to tumbling gas prices, the central bank has made it clear it doesn’t believe its job is done just yet.

“Simply put, there is more to be done,” Bank of Canada governor Tiff Macklem said during a speech in Halifax on Oct. 6.

As the Bank of Canada raises interest rates to bring inflation back to its two per cent target, officials at the central bank have expressed concern about how high inflation still is and its impact on consumer and business expectations for future inflation.

In September, the annual inflation rate slowed to 6.9 per cent, though the bank’s preferred core measures of inflation, which tend to be less volatile, were unchanged from August.

Grocery prices also continued to climb, with the cost of food up a staggering 11.4 per cent compared with a year ago.

There is some good news for the Bank of Canada on the inflation expectations front. Its recent business outlook survey showed businesses expect wages and prices to rise more slowly as their overall inflation expectations have eased.

The good news, however, won’t be enough to dissuade the bank from another sizable rate hike, Janzen said.

“There are some indicators that we’re past peak inflation rates. It’s just those inflation rates are still too high, currently, and still way too broad right now to prevent additional interest rate increases,” Janzen said.

Most commercial banks expect one more interest rate hike after October before the bank hits pause on one of its most aggressive rate-hiking cycles in history.

The effect of these rate hikes is expected to be felt more broadly in the economy next year as Canadians and businesses adjust their spending.

While there is some division among economists on how severe the impending economic slowdown will be, many economists estimate the chances of a recession have grown.

Recent surveys from the Bank of Canada reveal most Canadians and businesses also believe a recession is on the way.

However, many economists have highlighted that Canada’s tight labour market might serve as a buffer during an economic downturn. In September, the unemployment rate was 5.2 per cent, which is considered to be quite low.

Although the Bank of Canada has previously spoken about aiming for a “soft landing,” where inflation comes down without triggering a serious economic slowdown, Macklem said in recent weeks that the primary goal of the bank is to restore price stability.

That commitment has sparked worries in labour groups, which have come out against the aggressive rate-hiking path over concerns about the potential impact of a recession on employment.

A new report by the Centre for Future Work in collaboration with the Canadian Labour Congress is calling on the Bank of Canada to pause its rate hikes until it can assess the impact of previous interest rate increases on the economy.

“After three years of dealing with both the health and the economic consequences of an unprecedented pandemic, the last thing Canadians can tolerate is another recession,” the report by Jim Stanford reads.

Stanford, an economist and the director of the Centre for Future Work, makes the case in the report for a different approach to addressing high inflation.

Instead of continuing along the path of higher interest rates, Stanford recommends the Bank of Canada balance its goal of restoring low and stable inflation with promoting economic growth and maintaining employment.

In the report, Stanford also calls on the federal government to play a more active role in fighting inflation by exploring options such as tax increases on high-income earners and windfall taxes on profitable corporations.

Record high sales seen again in March

| For the second month in a row, sales activity not only reached a monthly high but also hit new record highs for any given month. Gains occurred across every property type as they all hit new record highs. An increase in new listings this month helped support the growth in sales activity. However, inventories have remained relatively low, ensuring the market continues to favour the seller. “While supply levels have improved from levels seen over the past four months, inventory levels are still well below what we traditionally see in March, thanks to stronger than expected sales activity,” said CREB® Chief Economist Ann-Marie Lurie. “With just over one month of supply in the market, the persistently tight market conditions continue to place significant upward pressure on prices.” With an unadjusted benchmark price of $518,600 this month, the monthly gain increased by another four per cent. After three consecutive gains, prices have risen by nearly $55,000 since December and currently sit nearly 18 per cent higher than last year’s levels. Despite the strong start to the year, price gains and rising lending rates are expected to weigh on demand in the second half of this year. Nonetheless, persistently tight conditions will likely continue to impact the market over the next several months. |

| Detached Sales continued to surge in March reaching record highs, thanks to a boost in new listings. Year-over-year sales growth occurred in every district of the city except the City Centre. The pullback in the City Centre is likely related to the significant drop in new listings, providing less choice for potential buyers. The months of supply for detached homes has been below one month since December. The exceptionally tight conditions have had a significant impact on home prices. The benchmark price for detached properties rose to $620,500 in March, which is over $73,000 higher than December levels and 20 per cent higher than levels recorded last year. Gains in prices have also caused a significant shift in the distribution of homes, where over 57 per cent of the available supply is priced over $600,000. Semi-Detached Semi-detached sales posted another record month of sales and year-to-date sales are over 43 per cent higher than last year. Improvements in new listings helped support some of the growth in sales but did little to improve the inventory situation. Inventory levels remain relatively low, causing the months of supply to remain nearly 70 per cent lower than long term trends for this time of year. Tight conditions caused prices to trend up again this month, for an unadjusted monthly gain of nearly four per cent. Prices trended up across all districts and are 16 per cent higher than last March. Year-over-year price gains have ranged from a low of nine per cent in the City Centre to a high of nearly 22 per cent in the North district. Row Row sales reached an all-time record high this month, contributing to year-to-date sales of 1,550 units, which is a 96 per cent increase over last year. An increase in new listings helped support the strong sales. However, inventory levels have been steadily declining compared to the previous year and are at the lowest March levels seen compared to the past seven years. Strong sales this month combined with the lower inventory levels saw the months of supply push below one month. The persistently tight conditions have placed significant upward pressure on prices. In March, the benchmark price reached $335,400, which is over four per cent higher than last month and nearly 17 per cent higher than last year. While strong gains have occurred across all districts of the city, the North East, North West, South and East districts have not yet recorded full price recovery from their previous highs. Apartment Condominium Apartment sales continued to surge in March, contributing to the best start of the year on record. The sudden shift in demand could be related to less supply choice in lower price ranges for other property types, causing many to turn to the condominium market. The rise in sales has outpaced the growth in new listings, causing inventories to ease compared to last year and the months of supply to drop to the lowest recorded since 2007. After several months of tight conditions, we are seeing upward pressure on prices. In March, the benchmark price rose to $265,900 – nearly three per cent higher than last month and six per cent higher than last year. The recent gain in price has helped support some price recovery in this sector, but prices remain over 11 per cent below previous highs. |

| REGIONAL MARKET FACTS |

| Airdrie For the second month in row, new listings in Airdrie reached a record high for the month. This helped support further sales growth in the city. The sales to new listings ratio has eased to 75 per cent, providing some opportunity to see inventory levels improve relative to figures recorded over the previous five months. However, inventory levels remain exceptionally low relative to sales, keeping the months of supply below one month. There has been less than one month of supply in this market since November of last year. The exceptionally tight conditions have caused significant gains in prices. In March, the benchmark price rose to $473,400, nearly 10 per cent higher than last month and 30 per cent higher than last year. The highest gains occurred for both detached and semi-detached homes. Cochrane Sales this month reached new record highs and are more than double the levels traditionally seen in March. Like most markets, Cochrane has struggled with strong demand relative to the supply. Inventory levels did edge up over last month but with only 86 units available, it is still among the lowest levels of March inventory recorded for the town. It was also the fifth consecutive month that the months of supply remained below one month. The persistently tight market conditions resulted in further price gains. In March, the benchmark price reached $520,000, which is nearly six per cent higher than last month and 23 per cent higher than last year’s levels. Okotoks Like Airdrie and Calgary, sales in Okotoks reached a new all-time record high this March. Improving sales were possible thanks to a gain in new listings. The increase in new listings this month also helped support some modest gains in inventory levels compared to what has been available in the market over the past seven months. However, with only 99 units available and 113 sales, the months of supply still remains exceptionally tight at under one month. Persistently tight market conditions have caused persistent upward pressure on prices. After five months of consecutive gains, the benchmark price in March reached $534,200, nearly 13 per cent higher than last year. |

Bank of Canada increases policy interest rate

The Bank of Canada today increased its target for the overnight rate to ½ %, with the Bank Rate at ¾ % and the deposit rate at ½ %. The Bank is continuing its reinvestment phase, keeping its overall holdings of Government of Canada bonds on its balance sheet roughly constant until such time as it becomes appropriate to allow the size of its balance sheet to decline.

The unprovoked invasion of Ukraine by Russia is a major new source of uncertainty. Prices for oil and other commodities have risen sharply. This will add to inflation around the world, and negative impacts on confidence and new supply disruptions could weigh on global growth. Financial market volatility has increased. The situation remains fluid and we are following events closely.

Global economic data has come in broadly in line with projections in the Bank’s January Monetary Policy Report (MPR). Economies are emerging from the impact of the Omicron variant of COVID-19 more quickly than expected, although the virus continues to circulate and the possibility of new variants remains a concern. Demand is robust, particularly in the United States. Global supply bottlenecks remain challenging, although there are indications that some constraints have eased.

Economic growth in Canada was very strong in the fourth quarter of last year at 6.7%. This is stronger than the Bank’s projection and confirms its view that economic slack has been absorbed. Both exports and imports have picked up, consistent with solid global demand. In January, the recovery in Canada’s labour market suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism. However, the rebound from Omicron now appears to be well in train: household spending is proving resilient and should strengthen further with the lifting of public health restrictions. Housing market activity is more elevated, adding further pressure to house prices. Overall, first-quarter growth is now looking more solid than previously projected.

CPI inflation is currently at 5.1%, as expected in January, and remains well above the Bank’s target range. Price increases have become more pervasive, and measures of core inflation have all risen. Poor harvests and higher transportation costs have pushed up food prices. The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities. All told, inflation is now expected to be higher in the near term than projected in January. Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards. The Bank will use its monetary policy tools to return inflation to the 2% target and keep inflation expectations well-anchored.

The policy rate is the Bank’s primary monetary policy instrument. As the economy continues to expand and inflation pressures remain elevated, the Governing Council expects interest rates will need to rise further. The Governing Council will also be considering when to end the reinvestment phase and allow its holdings of Government of Canada bonds to begin to shrink. The resulting quantitative tightening (QT) would complement increases in the policy interest rate. The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving the 2% inflation target.

Information note

The next scheduled date for announcing the overnight rate target is April 13, 2022. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR at the same time.

-Bank of Canada

Q3 2020 HOUSING REPORT

Third-quarter activity was far better than original expectations, as sales activity in the city improved by nearly 12 per cent over last year’s levels.

Some of the shift in the third quarter reflects activity that likely would have occurred in the second quarter. The housing market also benefited from easing lending rates and previous price declines. Gains were driven by all property types except apartment condominiums.

“As the economy started to re-open, we saw some improvements in the economic indicators,” said CREB® chief economist Ann-Marie Lurie.

“Most industries are not back to pre-pandemic levels, but over the past three months we have seen notable improvement across most industries.”

The gains this quarter did not offset all of the earlier declines, but the year-to-date decline eased to nine per cent. This is a significant improvement from the first half of the year, where sales were sitting 20 per cent below last year’s levels.

New listings were also on the rise. It was enough to cause inventories to trend up from the lower levels recorded earlier in the year, but inventories remain well below the levels recorded last year.

Overall, the months of supply did tighten to levels well below the past two years. Improved supply/demand balances did support some modest improvements in prices, which trended up in the third quarter compared to the second quarter and remained only one per cent below last year’s levels.

Current conditions in the housing market are surprising, but there are several reasons to still be cautious:

- The current job market: Unemployment levels remain exceptionally high and there is added concern regarding additional job losses coming in the energy sector. If this situation persists, it could result in weaker demand and rising listings.

- A second wave of COVID-19 and further shutdowns: Widespread closures are currently not expected, but if they do occur, this could be problematic for many businesses that cannot survive a second shutdown.

- Government support: The housing market and overall economy has benefited from significant government income support programs, and banks allowing homeowners to defer their mortgage. As these benefits end, there is a risk that some households will not be able to keep their home, causing a rise in new listings and pushing up supply levels. If this occurs, it could erode some of the recent gains in pricing.

-CREB

Digital devices in the classroom: A learning aid or a toxic distraction for kids?

While some schools are introducing iPads as part of their daily curriculum, and others are banning all digital devices entirely; the topic of devices in the classroom is hotly debated, especially as we enter Back To School season.

This recent article that went viral on Twitter recently demonstrates just how divisive this topic can be.

Many of us feel like the powerful folks in Silicon Valley, the ones who try and feed our kids more technology, are keeping it away from their own children.

So, are access to digital devices good or bad for helping kids learn in the classroom? Or is the answer more nuanced than that?

We took a look at the pros, cons and recent research to find out:

Why exposure to digital devices in the classroom is a good thing?

Whether we agree with it or not, technology is a big part of our lives and school-aged children today are very much digital natives: They grow up with technology rather than learning the skills as an adult (like many of us in the older generations who are more aptly named “digital immigrants.”)

In the US more than one of three middle school students report using smartphones (39%) and tablets (31%) to do homework according to a 2012 study commissioned by Verizon.

Much of the world that they already have, and will, interact with is digital. This includes the inevitable use of technology in their future careers. So why not have it as part of their education?

According to a study by the IT Trade Association, educators say that developing technological skills with their students is important preparation for joining the workforce later in life.

Students need to be device and mobile literate for their careers, and the students themselves seem to concur; with nine out of ten agreeing that using technology in the classroom would help prepare them for the digital future.

Alongside this is the importance of promoting good digital citizenship. Using the internet effectively, responsibly and safely are important skills which should be developed by parents, educators and school counselors.

Do digital devices in the classroom help kids learn?

While the argument for digital device education and experience seems strong, is this sort of technology in the classroom actually beneficial to learning?

As Vawn Himmelsbach, Education Technology writer, points out; there are seemingly lots of reasons why online digital devices help in the learning environment. Not only do students have access to a vast world of information and learning materials but that this kind of technology allows students to learn at their own pace through individualized instruction.

Also, rather than just passively learning in the classroom, kids become more much interactive with the teacher thus they become more of an advisor or coach as the kids explore their learning more independently.

Lastly, using online polls, quizzes and similar activities could help engage all students, including those who are normally shy and wouldn’t always raise their hand in class to participate.

It’s no wonder that, in a recent survey, around 75% of educators think technology has a positive impact in the education process.

While this sounds promising, and there are clear advantages to having technology in the classroom, the current research in this area suggests that we should be cautious with how we use it and that learning can just as quickly be hindered by these same devices.

What the research says:

While some devices can be of benefit, there’s a plethora of research also suggesting that many of these devices, especially laptops, distract from learning. Not only for the student using the device but for those around them.

In one particular study they found that, regardless of the duration, any laptop use negatively affects students learning in terms of information recollection. This is backed by the fact that multitasking and distraction devices affect our ability to study, as we outlined in our recent article on “How to stay focused while studying”.

This is certainly true when the device allows for browsing that isn’t relevant to the studies. But another study reported that, even when the device allows for relevant information browsing and school-related apps and sites, that this isn’t helpful for learning either.

When it comes to devices like iPads, which have growing popularity in classes for much younger students, the results seem much the same.

While people (students and educators alike) report enjoying having them in the classroom, there is much concern around the potential to be distracted by them.

It’s also worth noting that handwriting, rather than typing, is very beneficial to information processing, focus and memory. Read more about it in our recent article on the benefits of handwriting.

We also recently explored the latest trend of embracing doodling in the classroom as well. Which is shown to have similar benefits.

Conclusion? It’s not the device, it’s the distraction.

Being able to use digital devices efficiently is an important part of education for young digital natives and there seems to be lots of good arguments for the benefits of these technologies to aid learning.

However, many of these devices are proving to be too distracting and come with platforms and apps that are inherently designed to be addictive and steal your focus.

This is what drives our philosophy at reMarkable. We created a new type of device as a protest to the distractions that surround us every day. A digital tool designed to reclaim our thoughts and focus. Setting a new direction for human-friendly technology.

-Medium

Excitement builds around Calgary’s first laneway shipping-container home

Calgary-based Modern Huts is constructing the city’s first laneway container home in a Killarney backyard.

MODERN HUTS

The Killarney project is easing regulations to allow for off-site prefabrication, and the builder believes it will be the first of many homes like it

In a backyard in the southwest community of Killarney, three shipping containers are being positioned above a two-car garage to create 480 square feet of living space for Chad Saunders and his wife, Jennifer Head. The finished residence will be the first laneway shipping-container home in Calgary.

Jeremy Johnson, founder of the Calgary-based builder responsible, Modern Huts, believes it will be the first of many.

“Since the containers were put in position a couple of weeks ago, we’ve had a lot of inquiries on costs and timescales,” Mr. Johnson says. “Killarney is a community which is pretty open to density and innovation and people are interested and excited to see something like this come to Calgary.”

A rendering of the finished Calgary home, which will provide 480 square feet of living space.

NEW CENTURY DESIGN

“Most container companies are building laneway homes fully modular and then moving the completed units into position, which is a very efficient and economical way to build, but we’re having to site-build for this project because of the city’s inspection process. They want to see all the processes as the build unfolds,” he says.

This has meant Mr. Johnson and his team will be on site for approximately three months, rather than the five days which would be required were they permitted to complete the build off-site.

Since starting the project, Mr. Johnson says this particular inspection process has been revised and the city will allow container homes to be built fully prefabricated in future.

“Until now, you could use modular building techniques but the city was sticky on anything that was fully prefabbed and delivered, even with modular homes,” he says. “Laneway – and specifically container homes – are still very new to Calgary so the city has been pretty cautious, but we’re seeing that change now, which is good news.”

Despite the challenges, Mr. Johnson says the build, which is his company’s third container home, is going well. He expects the entire one-bedroom suite, including the two-car garage underneath, to come in around $130,000.

“The cost to build will be similar to a stick-frame build but it will be quicker, even without building off-site, more durable and will result in a far more energy efficient building. The R-values we’re reaching are really high and we’re hopeful of achieving Passive [House] standards someday,” he says. (Passive House is a standard for ultralow energy efficiency.)

“The exterior of the suite is being left largely as metal, so will require virtually no maintenance, and we’re also generating a lot less garbage,” Mr. Johnson says. “We have eight bags of garbage on site right now and drywall starts this week. With a stick build, at the same stage, we’d have a full bin of waste leaving the site already.”

Upon completion in March, Mr. Saunders and Ms. Head will move into the container suite with their eight-year-old son while Mr. Johnson renovates their 1950 bungalow. Mr. Saunders has owned the property on the corner of 32nd St. and 26thAve. S.W. for 19 years. He bought it as a starter home but, as the years passed, he and his wife started talking about paying off the mortgage and renovating, rather than moving.

“When we started to approach builders about doing a renovation, most of them said we’d be better to knock the house down and built from scratch, but we really weren’t interested in building a monster house,” he says. “When Jeremy suggested we include the old garage in the reno, that’s when we started to think about putting in a suite. We’ve always liked the idea of shipping-container homes – what they stand for from an environmental perspective and also how they look.”

Chad Saunders and his wife, Jennifer Head, like how shipping-container homes look and ‘what they stand for from an environmental perspective.’

MODERN HUTS

The couple have no firm long-term plans for their garage-top property yet but Mr. Saunders, who works in the arts, says they could end up letting it out to an artist in residence.

“If we find the perfect renter, then great, but we’re also considering options with organizations like Alberta Ballet which need temporary accommodation for artists from time to time. We think that could be a really fun and interesting way to use the space,” he says. “We actually hope to engage a local artist to create a mural on the side of the container which faces into the yard when it’s finished, too.”

Mr. Saunders also sees long-term value in having a second residence on the family property.

“We know from relatives how expensive care facilities can be and how challenging that is for seniors. We figure that maybe in 30 years, if our family needs a caregiver, someone could move into that house. It doesn’t hurt to think ahead and have options,” he says. “We’d rather diversify the land we have now than build a huge house that we’ll struggle to take care of in the future.”

Mr. Johnson says caregiving is one of the main motivators for clients inquiring with his company about laneway homes.

“When we finish this project, we move onto another shipping container laneway home in Silver Springs. It’ll be a four-container suite providing 640 square feet of living space and two bedrooms for a daughter and her son who are moving back onto the family property to provide care to her parents,” he says. “Silver Springs is a neighbourhood where you find a lot of retirees and we’ve had other inquiries for the same kind of project from that community.”

Other projects planned for summer include a laneway office for a client in Mount Royal and a solar-powered, hydroponic greenhouse for a client in Briar Hill who’s interested in year-round growing. Both would be fashioned from a single shipping container.

Mr. Johnson says in time he’s like to start to prefabricate shipping container suites and have them shipped across Canada. But, for now, he’s focusing on the local market in Calgary where laneway homes are becoming more common and, he says, there’s “virtually no competition for small-scale, backyard shipping-container projects.”